What the top 100 AI apps in 2025 say about the future

a16z's top 100 AI consumer apps ranking tells us about who’s winning, what’s working, and where this is all going.

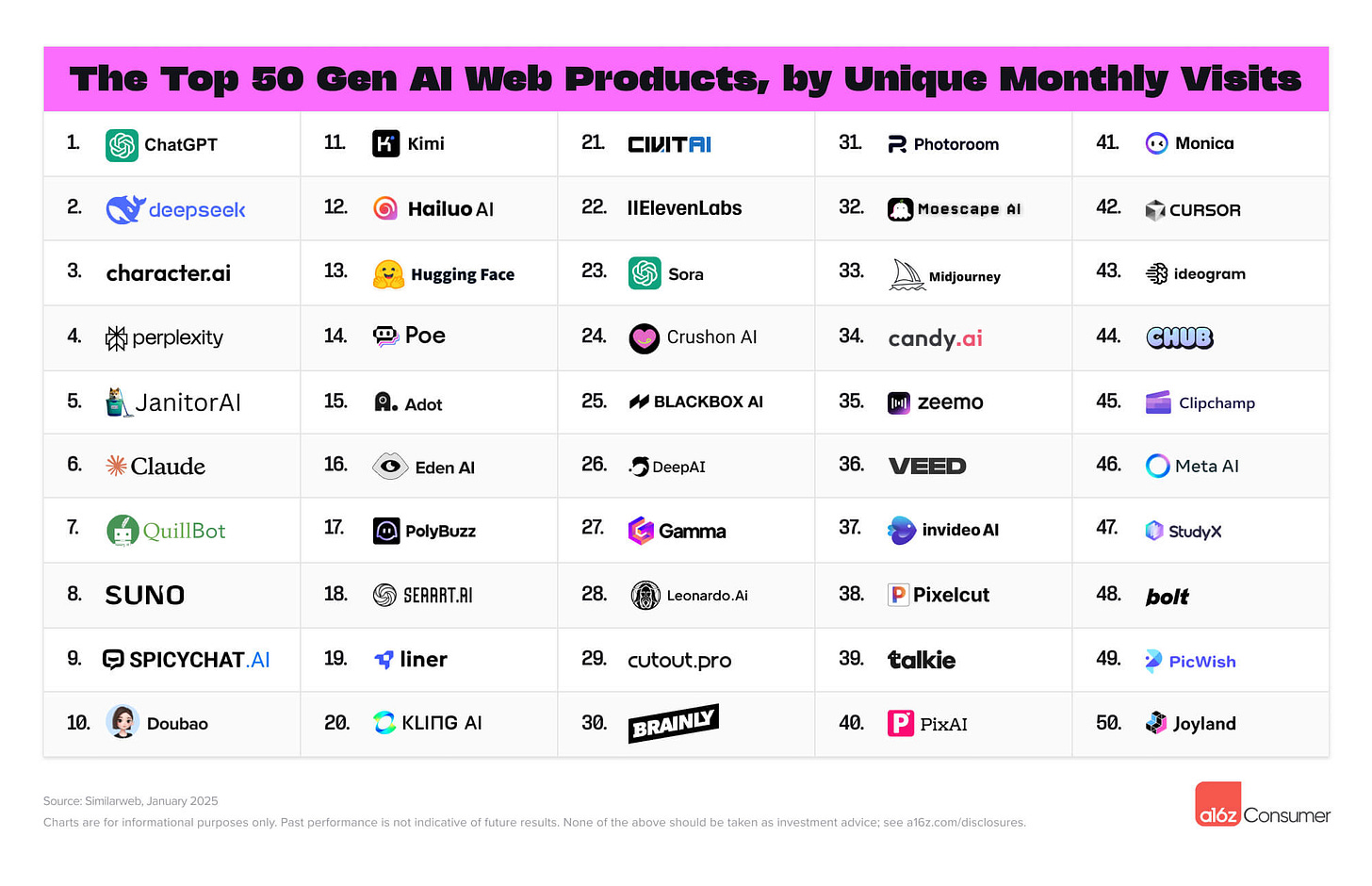

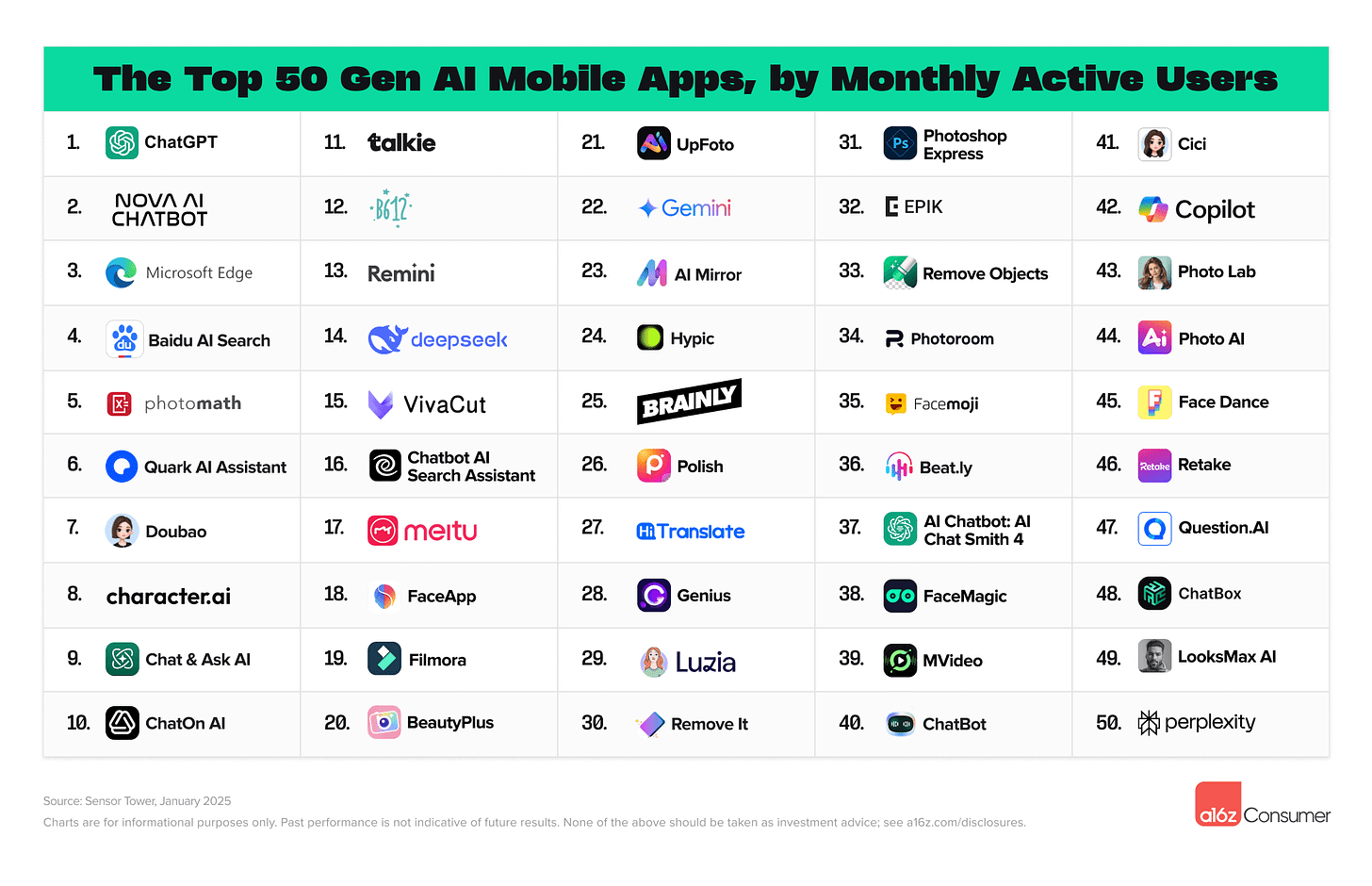

In its fourth edition of the Top 100 Gen AI Consumer Apps, a16z just dropped a data-rich breakdown of the fastest-growing, most-used, and highest-earning AI-native products across web and mobile—and it reads like a snapshot of the AI future unfolding in real time.

Here are the biggest takeaways from the report—and why they matter.

ChatGPT’s second wind is bigger than its first

After a sluggish 2023 where user growth flatlined, ChatGPT is suddenly growing faster than ever. The app surged from 100M to 400M weekly active users in under 9 months, defying the usual "big apps grow slow" logic. Why? Product drops.

GPT-4o (April 2024): Multimodal AI that could see, hear, and talk? People were into it.

Advanced Voice Mode (July): Think Siri on steroids, but useful.

o1 Model (September): More logic, better problem-solving, less hallucinating.

And while the web version boomed, mobile was no slouch—175M mobile users are now part of ChatGPT's total base.

DeepSeek went from zero to viral rocketship in 20 days

Never heard of DeepSeek? You’re not alone—unless you're in China, where ChatGPT is banned and DeepSeek swooped in to fill the void. Launched in January 2025 by a Chinese hedge fund (yes, really), DeepSeek hit:

#2 in global traffic in just 10 days

10M users in 20 days (twice as fast as ChatGPT hit that milestone)

15% of ChatGPT’s mobile user base by February

It’s also making headlines for claiming it trained its flagship model for just $5.6 million—a fraction of what OpenAI or Anthropic spend. That number turned heads and triggered the media’s favorite phrase: “a Sputnik moment for AI.”

But not everyone is thrilled. DeepSeek is already banned or restricted in places like South Korea, Taiwan, and Australia, and blocked on government devices in parts of the U.S.

AI video stopped being a joke — kind of

For the past year and a half, AI video has been all promise, no polish. That’s finally changing. Hailuo, Kling AI, and Sora are leading the charge, with real (and actually watchable) outputs.

Each model is starting to differentiate:

Sora is the all-rounder

Hailuo nails prompt accuracy

Kling adds cool extras like lip sync and camera movement

Meanwhile, editing apps like Veed, Clipchamp, VivaCut, and Filmora are climbing the charts by streamlining painful workflows—think automatic clipping, captions, and one-click scene editing.

Still, quality varies, and if you want pro-tier video, tools like Google’s Veo 2 (at $0.50/second) suggest we’re not out of the woods yet.

The rise of “vibe coders” and agentic IDEs

There’s a new line being drawn in AI creation: coders vs. vibe coders.

On one side, you’ve got agentic IDEs like Cursor, acting as copilots for devs: bug fixing, code autocompletion, full-blown code generation. Cursor now serves hundreds of thousands of devs.

On the other, tools like Bolt and Lovable let you type a prompt and get a working web app—no coding required.

The numbers are wild:

Bolt: $20M ARR, 2M users in two months

Lovable: $17M ARR in three months

And yes, there's overlap: 23% of Bolt users also hit up Cursor. Builders gonna build, no matter the stack.

Popular ≠ profitable: usage and revenue tell different stories

You’d think the most-used apps make the most money. You’d be wrong.

Only 40% of top apps by monthly active users (MAUs) also ranked in the top for mobile revenue. Why? Niches monetize.

Plant ID apps, language tutors, and nutrition trackers had far fewer users—but those users paid.

Even ChatGPT clones (yes, still a thing) raked in 12% of usage and revenue with app store SEO tricks and low-price premium pitches.

Meanwhile, photo/video editing remains the largest category in both usage and revenue, but not with the same apps.

Mass-market appeal = lots of users. Prosumer features = more $$$.

The bottom line: AI-native apps are moving from hype to habit

This isn’t just about launches and downloads anymore. The apps that matter are:

Getting daily use

Monetizing beyond ads

Specializing in real workflows

a16z’s Top 100 list shows that consumer AI is settling in. The tools are getting stickier, the use cases more concrete, and the stakes much higher.

The next breakout app might not be a better chatbot. It might be the thing that helps you build a chatbot without writing a line of code—and then turns it into a product people actually use.