Loyalty as a Growth Lever

How leading companies transform loyalty programs into engines of sustainable growth

In an era where customer acquisition costs soar and retention is paramount, a quiet revolution is redefining the go-to-market playbook. The most successful companies aren't just selling products; they're architecting 'loyalty-led growth' engines that transform casual users into an unshakeable base of advocates and drive exponential revenue. This article will unpack how industry leaders are moving beyond traditional perks, leveraging loyalty programs as strategic levers for acquisition, engagement, and unprecedented customer lifetime value.

Benefits of Loyalty Products

Why do some companies manage to transform casual users into lifelong advocates, while others struggle to keep customers engaged beyond the first transaction? The answer often lies in how well they design and execute loyalty programs.

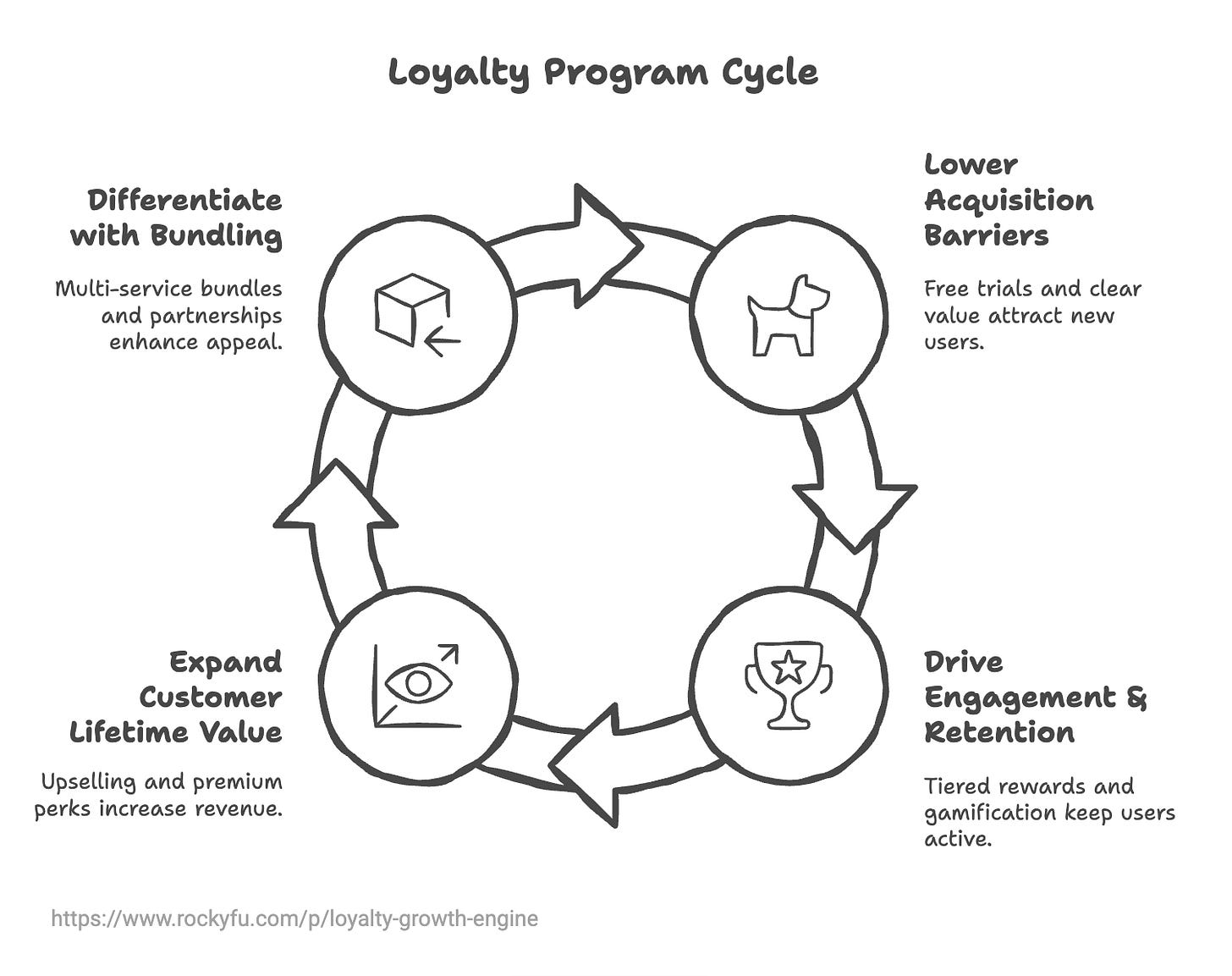

Loyalty is not about points or perks alone; it is about addressing core growth pain points. Acquisition is costly, churn erodes margins, and customer lifetime value is difficult to maximize without sustained engagement.

A well-structured loyalty program tackles each of these challenges. It lowers the barrier to entry with clear value, it fosters repeat usage through gamified milestones and recognition, and it expands share of wallet by nudging users into new products or premium tiers.

The proof is visible across industries. Amazon Prime reshaped e-commerce loyalty, turning a simple free-shipping benefit into an ecosystem where members spend more than twice as much as non-members. This staggering difference underscores loyalty’s direct impact on the bottom line.

Grab in Southeast Asia built its super-app loyalty strategy around both free rewards and paid subscriptions, making "a dollar spent with Grab more valuable than a dollar spent elsewhere".

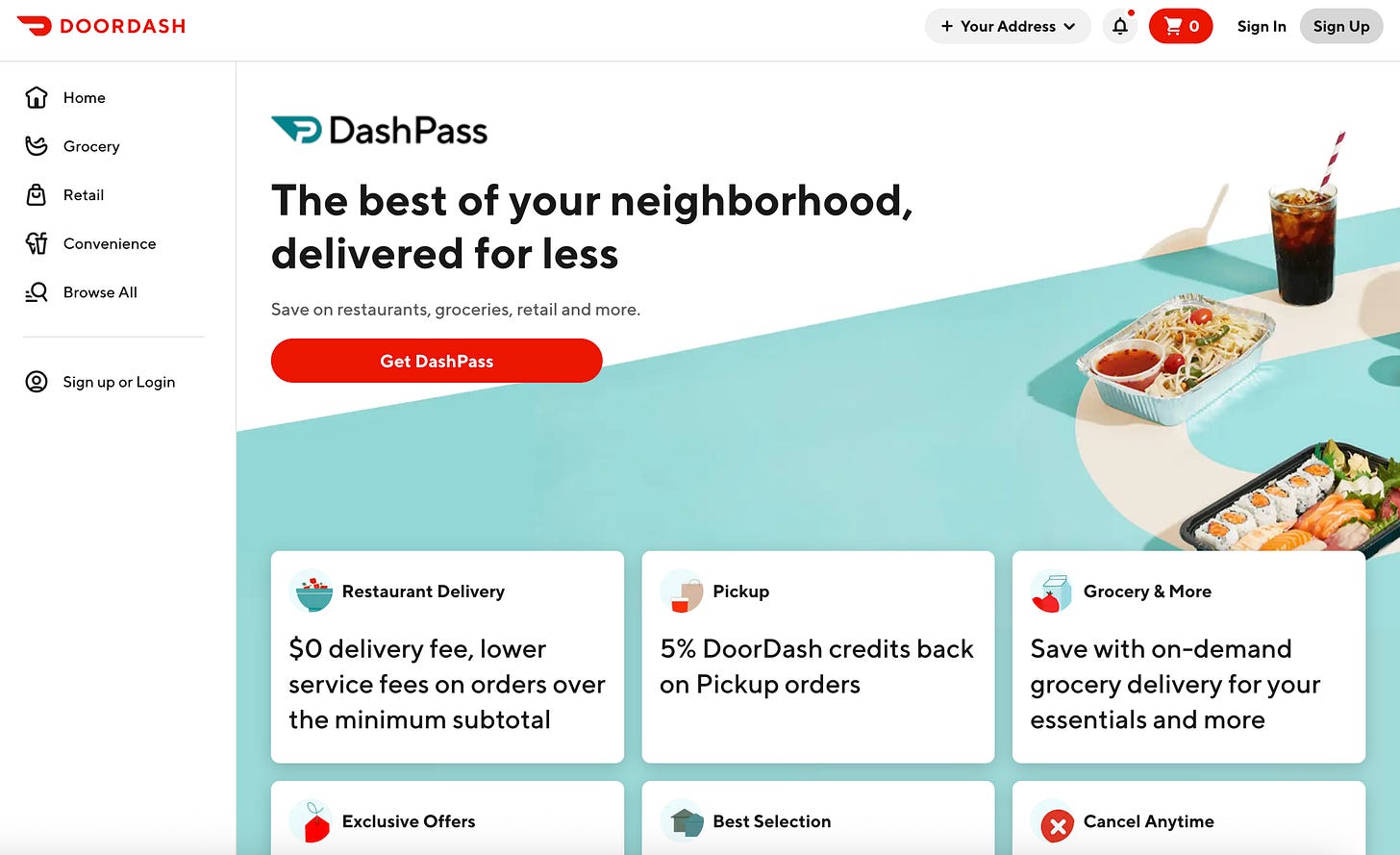

DoorDash grew DashPass into a household subscription with over 18 million members, proving that loyalty can be a competitive moat rather than just a marketing add-on.

Loyalty programs, when designed as growth engines, are no longer cost centers. They are scalable GTM levers that acquire, retain, and expand users more effectively than traditional campaigns. The companies that master this shift create not just customers, but communities that continuously fuel their growth.

Lowering Barriers to Acquisition

Every growth leader knows that acquisition is expensive, yet the real hurdle is not awareness but conversion. Users hesitate to commit unless the value is immediate and undeniable. Loyalty programs that succeed at scale begin by reducing friction at the very first touchpoint.

Free trials and introductory offers are a proven way to remove hesitation.

Amazon popularized the 30-day free trial for Prime, creating a risk-free entry point that later converted millions into paying members. Uber applied the same principle when transitioning from Uber Rewards to Uber One, offering a complimentary month to showcase the savings and convenience of its subscription.

By giving customers a chance to experience the benefits firsthand, these companies effectively turned trial into habit.

Equally important is clear value communication.

DoorDash demonstrates this with DashPass by quantifying the impact: subscribers have saved billions in delivery fees, with an average of five dollars saved per order. These tangible, quantifiable savings are the bedrock of trust and continued subscription.

Grab went further by creating a "Savings Simulator" to show users how quickly membership pays for itself across rides and deliveries.

These tactics do more than market features; they address the underlying psychological barrier of cost sensitivity with hard numbers that make the decision obvious.

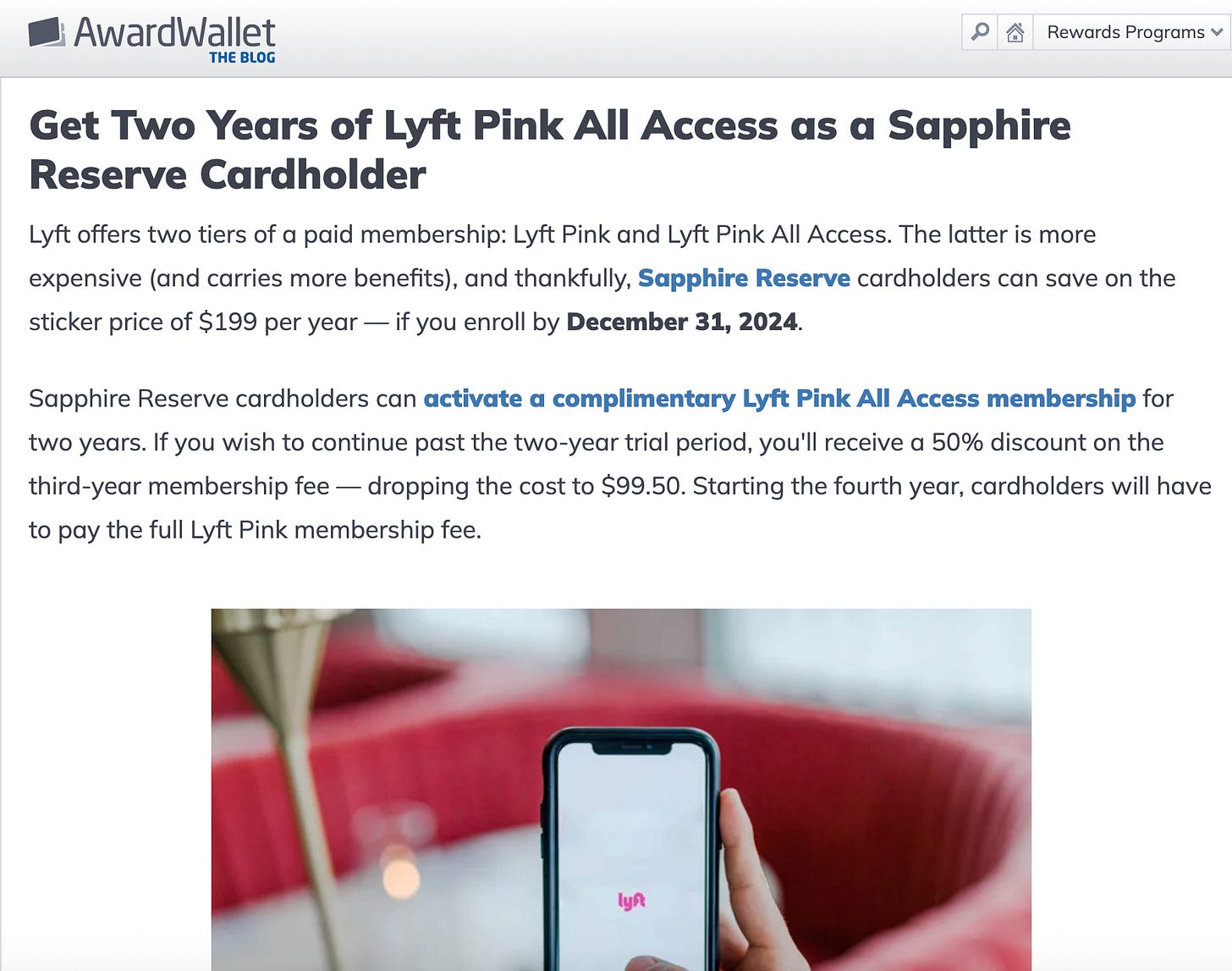

Partnerships also play a critical role in acquisition.

Fintech and telco tie-ups, such as Chase offering Lyft Pink or regional telcos bundling streaming memberships, help loyalty programs piggyback on existing customer bases. For the end user, the membership feels like an added bonus rather than an expense, which accelerates adoption.

The growth marketing takeaway is simple: acquisition in loyalty programs is not about discounts alone. It is about removing doubt, demonstrating tangible value from the outset, and embedding memberships where customers already spend their time and money.

When acquisition is treated as the first step in building long-term trust, loyalty programs move from optional perks to essential gateways into the ecosystem.

However, acquiring users is only the first skirmish. The true battleground for sustained growth lies in cultivating enduring engagement and preventing churn.

Driving Engagement and Retention

Acquiring users is only half the battle. The real measure of a loyalty program's success lies in how effectively it keeps members active, engaged, and unwilling to churn.

Retention is not achieved by static benefits alone; it requires dynamic systems that create momentum, recognition, and emotional attachment.

Tiered structures are among the most powerful tools in this playbook.

Shopee Rewards, for instance, cycles customers through Classic to Platinum status every six months, requiring consistent spending to maintain their tier. This creates urgency and builds habits, turning occasional shoppers into regular transactors who strive to protect their progress.

GrabRewards operates on a similar principle, positioning every dollar spent within its ecosystem as more valuable than money spent elsewhere. These frameworks transform loyalty from passive participation into an ongoing pursuit of recognition.

Gamification adds another dimension.

DoorDash challenges its members with streaks and milestone-based rewards, while Grab introduces in-app missions like ordering multiple times a week for bonus points.

These mechanisms tap into intrinsic motivations: progress, achievement, and the fear of losing benefits, driving frequency beyond what discounts alone can achieve.

Retention also thrives on immediacy and flexibility.

Grab introduced a "burn toggle" that allows members to apply small amounts of points instantly at checkout, delivering the gratification of savings in real time. Coupled with occasional surprise rewards, like bonus credits or mystery gifts, this injects delight into everyday transactions.

Such gestures, though modest, create disproportionate goodwill because they feel unexpected and personal.

Finally, personalization elevates engagement from transactional to relational.

Amazon tailors recommendations and early access offers to Prime members' purchase histories while DoorDash sends geo-targeted prompts like soup discounts on cold evenings. These data-driven nudges ensure that loyalty remains relevant and top of mind, reinforcing the perception that the program understands and anticipates user needs.

The growth insight is clear: retention is not a defensive move but an active design.

By layering status, gamification, immediacy, and personalization, companies build ecosystems that reward users at every step and make switching costs psychological as much as financial.

A well-executed loyalty program does more than keep customers; it keeps them invested.

Retention creates stability, but stability alone does not guarantee growth. For a loyalty program to become a true growth engine, it must also expand the economic value of each user. This is where cross-sell and upsell strategies come in: turning a retained customer into a higher-value customer, and in turn, boosting Customer Lifetime Value (CLV).

Cross-Sell and Upsell to Expand CLV

CLV matters because it defines the long-term profitability of the user base, guiding how much a company can sustainably invest in acquisition and engagement.

The most effective loyalty programs use unified rewards to encourage cross-category usage.

Grab's ecosystem illustrates this well: points earned from ride-hailing can also be redeemed for food delivery, groceries, or even travel perks. The result is a natural incentive for a user who joined for one service to explore others, steadily increasing their engagement and spend within the platform.

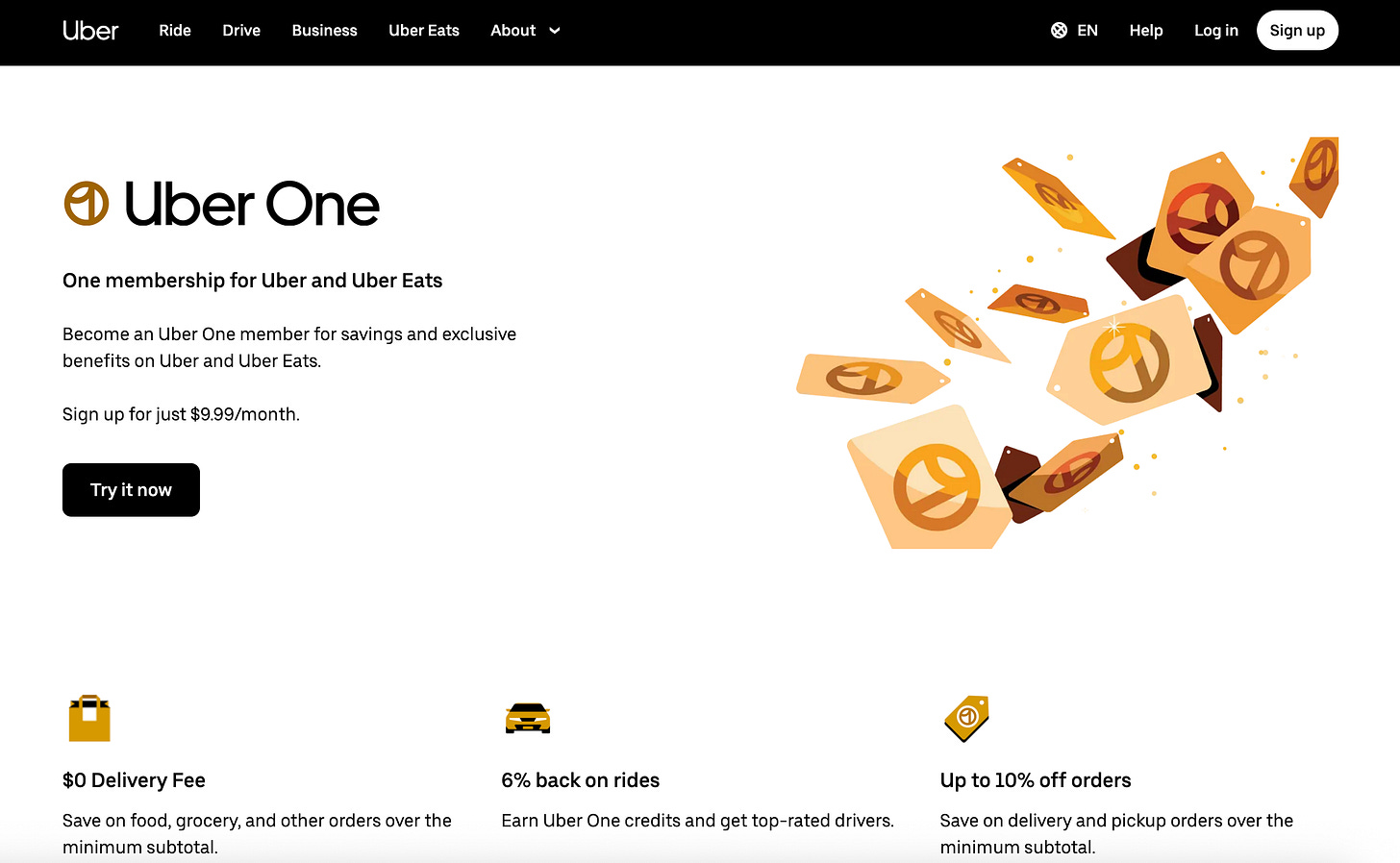

Similarly, Uber One merges mobility and delivery, giving members consistent benefits across rides and Eats, reducing the temptation to try competitors.

Upsell is the other side of this equation.

Many companies seed habits with free tiers, then nudge their most active users toward premium plans. Uber did this by retiring its free Uber Rewards and offering loyal riders a free trial of Uber One, effectively converting habit into subscription revenue.

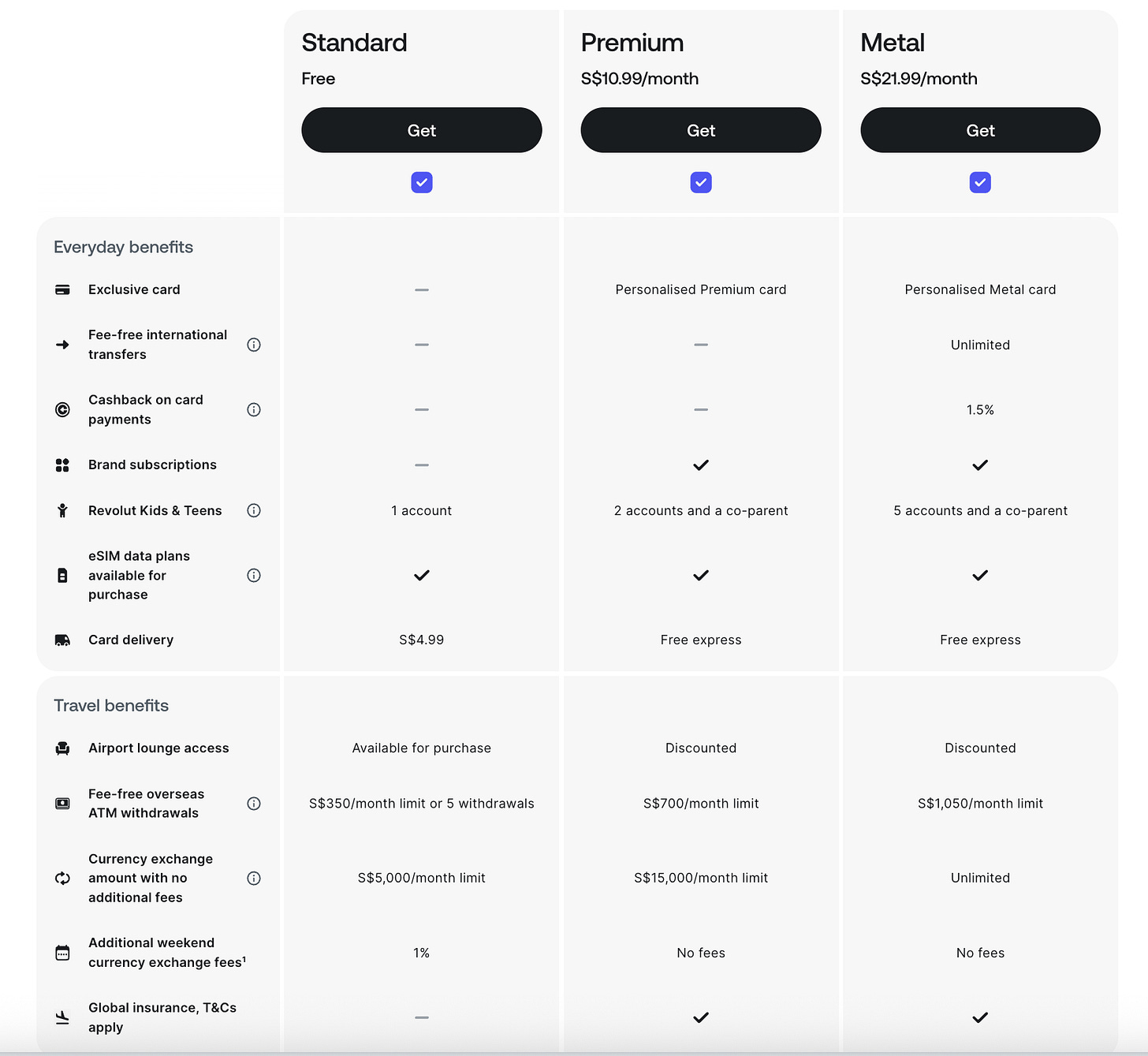

Revolut takes a different path by stacking exclusive features, from higher ATM limits to lifestyle subscriptions, into its Premium and Metal tiers, giving customers clear reasons to ascend.

These strategies prove that loyalty can monetize not only breadth of usage but also depth of commitment.

Cross-platform partnerships further extend value.

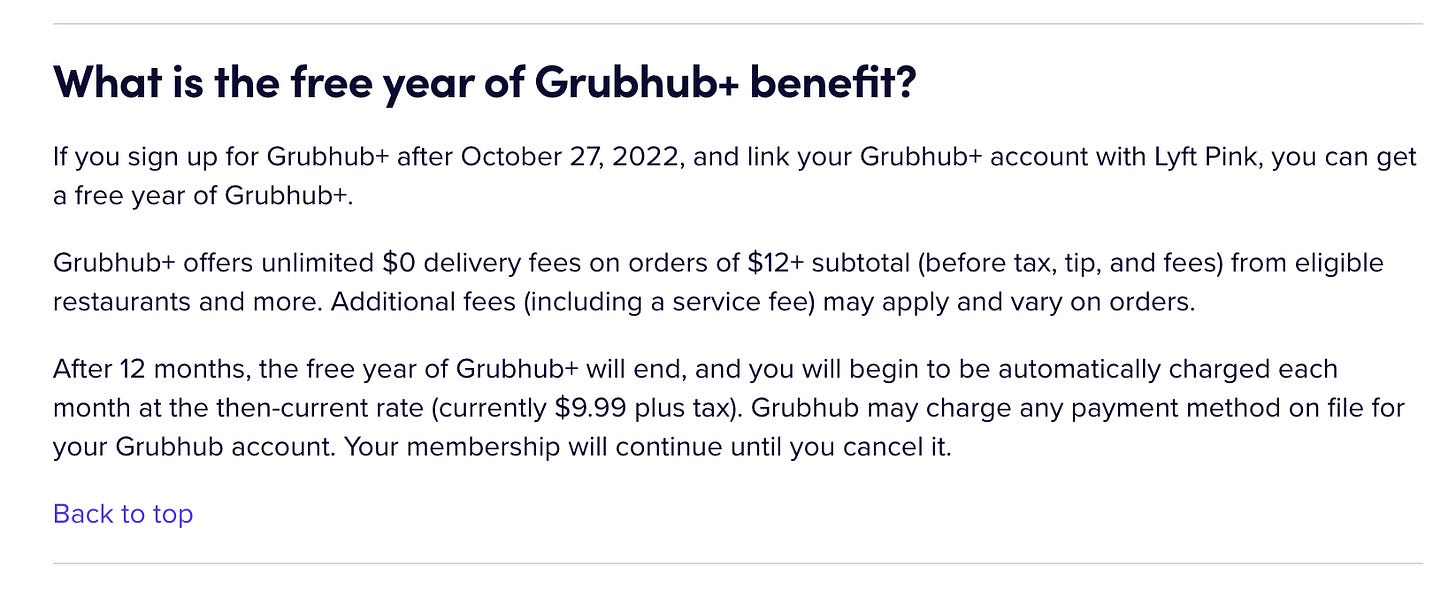

The Lyft and Grubhub tie-up, or Amazon's bundling of Grubhub+ into Prime, expose members to entirely new services through the halo of loyalty. For the customer, the benefit feels like added value at no extra cost; for the companies, it is a cost-effective way to grow share of wallet.

The takeaway for growth leaders is direct: loyalty should not be viewed as a retention silo but as a funnel for expansion. By weaving cross-sell opportunities into everyday benefits and designing clear upgrade paths, companies maximize CLV while making users feel they are the ones winning.

In practice, this transforms loyalty programs into growth multipliers: each new transaction, each upgrade, each bundled perk reinforcing both the customer's satisfaction and the company's bottom line.

Bundling as a Differentiator

While cross-sell and upsell expand customer lifetime value by nudging users into more categories or higher tiers, bundling plays a different role. Bundling is about long-term defensibility, creating an ecosystem so comprehensive that customers find little reason to leave.

It shifts loyalty from being a growth lever to becoming a competitive moat.

Amazon Prime exemplifies this shift. What started as free two-day shipping grew into an integrated lifestyle subscription with video, music, reading, and exclusive shopping events.

The breadth of benefits ensures that even if one feature is underused, others still justify the subscription. This layered value strengthens retention and drives members to spend more than double compared to non-members.

In Asia-Pacific, super-apps like Grab apply the same principle with local nuance. GrabUnlimited packages ride discounts, food delivery perks, and grocery savings into a single plan. This makes Grab not just a provider of services but a default daily companion.

DoorDash followed a similar path by broadening DashPass from food delivery into groceries, retail, and mobility through its partnership with Lyft, signaling a move from single-vertical utility to multi-category lifestyle bundle.

Coalition bundling offers yet another model.

Lazada's LiveUp program, for instance, pulled together e-commerce, groceries, streaming, and rides in one membership to counter Amazon's entry into Southeast Asia. Though coordination across industries is complex, the result demonstrated how bundling can elevate loyalty into a market-wide play, not just a company-specific tactic.

From a GTM lens, bundling changes the conversation. Instead of competing on price or features, companies differentiate through comprehensiveness and convenience.

By aggregating multiple forms of value under one roof, bundling raises switching costs, increases relevance across contexts, and establishes loyalty as a strategic asset. It is about ensuring customers never feel the need to look elsewhere.

Conclusion

Loyalty programs are no longer side campaigns tucked under marketing. They are frontline GTM strategies that shape how companies acquire, retain, and expand their user base.

When designed well, they lower entry barriers with clear value, they build habits through engagement, they unlock higher CLV through cross-sell and upsell, and they create defensibility through bundling.

The lesson for growth and product marketing leaders is straightforward: loyalty is not about giving away discounts; it is about engineering long-term economics. Amazon Prime, Uber, and DashPass each demonstrate that loyalty done right can double user spend, elevate retention to industry-leading levels, and build moats that competitors struggle to breach.

For GTM professionals, the challenge is to treat loyalty programs as ecosystems rather than perks. Every benefit should map back to a growth objective from onboarding the hesitant user, to retaining the regular, to expanding the committed.

By aligning loyalty design with business outcomes, companies move beyond transactional incentives to create enduring growth engines.

In today's crowded markets, the brands that win will be those that transform loyalty into strategy: simple at the entry point, engaging in the journey, expansive in value, and differentiated in the market. That is the true power of loyalty as a growth lever.