The $175 billion GenAI surge in APAC

Asia Pacific’s AI and GenAI investments are set to hit $175B by 2028, signaling a shift from experimentation to enterprise-scale transformation.

The Asia Pacific region, spanning powerhouses like China and Japan, is entering a defining era of AI investment.

According to IDC’s latest Worldwide AI and Generative AI Spending Guide, AI and GenAI spending will reach US$175 billion by 2028, growing at a staggering 33.6% CAGR from 2023.

Of that, Generative AI alone is expected to surge 59.2% annually, hitting US$54.5 billion, or roughly 31% of the entire AI market.

What we're seeing isn’t just a technology upgrade — it’s a strategic shift. One that repositions AI from pilot programs and isolated tools to enterprise-wide frameworks shaping customer experiences, operations, and innovation agendas.

The shift from experimentation to embedded intelligence

The most forward-thinking enterprises are already transitioning from use-case experimentation to operational-scale deployment.

From intelligent customer engagement to automated cybersecurity and decision intelligence, GenAI is being folded into the core fabric of business processes.

2025 will be the year of unified AI platforms

says Deepika Giri, head of research at IDC APJ.

These platforms will power AI agents across predictive, generative, and prescriptive models — supported by integrated infrastructure, data pipelines, and governance frameworks.

These platforms represent more than technical cohesion. They signal the rise of AI as a strategic business system, no longer siloed in IT but championed at the C-suite level.

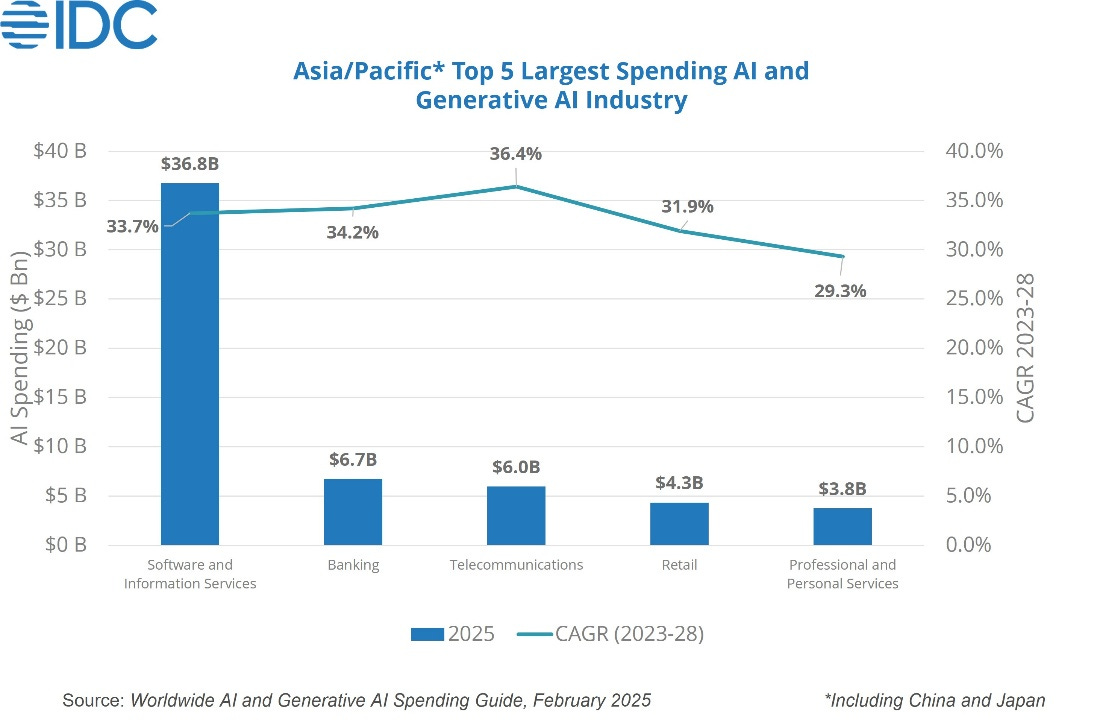

Sectoral Disruption: From Finance to Telco and Retail

Not all industries are moving at the same pace — but some are leading the charge.

Software & information services will command over 40% of total AI spending in 2025, with significant momentum behind AI development platforms and cloud-native infrastructure.

Banking and financial services are adopting AI to drive real-time fraud detection, improve operational agility, and deliver hyper-personalized experiences at scale.

Telecommunications and retail are using GenAI to reimagine network efficiency, logistics, inventory management, and customer service — all in response to rising consumer expectations in a digital-first economy.

What binds these industries together is a shift toward data-centric, outcome-driven AI strategies that create competitive differentiation through intelligence and adaptability.

The Infrastructure Race Is On

Behind every AI innovation is an infrastructure story — and Asia Pacific is rapidly building the digital backbone required to support it.

According to IDC, AI infrastructure provisioning — from cloud computing and GPUs to advanced data centers — now accounts for 37% of all AI and GenAI investments.

That’s a signal: without scalable, reliable, and low-latency infrastructure, AI initiatives can’t move beyond proof-of-concept.

This arms race for infrastructure is setting the stage for:

24/7 AI agents and assistants

Enhanced field service operations

Mission-critical applications in defense and public safety

From chatbots in financial services to real-time emergency response systems, APAC’s AI footprint is broadening — and fast.

Top AI/GenAI Use Cases in APAC

From AI-enhanced fraud detection to next-gen customer service, the Asia Pacific region is doubling down on practical, high-impact AI use cases.

According to IDC, augmented contact centers, guided selling, and fraud analysis are leading the AI investment charge — not just growing fast, but fundamentally reshaping how businesses engage customers.

While AI-enabled self-service and IT optimization are scaling quickly, it's the AI infrastructure provisioning that still commands the lion’s share of spend — a quiet but powerful indicator that enterprises are laying serious groundwork for long-term GenAI deployment.

Elsewhere, governments are turning to AI for national security, emergency response, and threat prevention — a reminder that GenAI's potential extends far beyond the boardroom.

The takeaway?

APAC isn’t just experimenting with AI — it’s operationalizing it, fast.

Why Senior Executives Should Care Now

This isn’t just about riding the AI hype wave.

It’s about rethinking enterprise architecture, business models, and competitive strategy in the face of accelerating AI maturity.

AI and GenAI are:

Redefining what operational efficiency means

Reshaping how value is delivered to customers

Reconstructing decision-making at every level

As we move into 2025, C-level leaders must align on three fronts:

Platform standardization: Invest in unified AI frameworks that can scale across business units.

Infrastructure readiness: Partner with vendors and cloud providers to build AI-ready environments.

Strategic use case prioritization: Focus resources on high-impact use cases aligned with business KPIs — not just tech demos.

The Bottom Line

The APAC region is no longer just participating in the AI race — it’s leading it.

With US$175 billion in projected spending and GenAI growing faster than any other digital technology, we are witnessing the dawn of a new strategic paradigm.

For senior executives, the call to action is clear: AI must move from project to platform, from tool to transformation.

The companies that win will be those that treat AI not as a line item in IT, but as a boardroom priority.